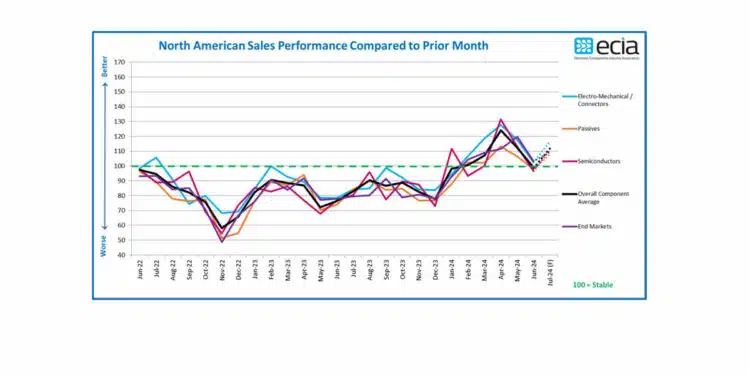

ECIA’s Electronic Component Sales Trend Sentiment ECST for the second month in a row delivered disappointing, declining results in June 2024.

The overall component index fell by 13.4 points in the June survey to slip below the 100-point threshold down to 98.9 points on the index. The combined decline of over 25 points across May and June erased all upward progress that had been achieved since the start of the year in January. Once again, survey respondents expect a rebound in July with the outlook calling for an improvement of 13 points, recovering to 111.9.

However, after two consecutive months of major forecast misses, confidence in this outlook is shaky at best. All three major component segments saw sharp declines with Semiconductors suffering the steepest drop as the segment dropped by 16.2 points in June and nearly 35 points with May and June

combined.

Electro-Mechanical components saw its score collapse by 15.1 points in June resulting in an overall decline of over 25 points during the past 2 months. Passives experienced a relatively moderate decline by comparison as the segment dropped by 8.7 points in June culminating in a decline of 15.5 points through May and June.

Market sentiment for the first half of 2024 has essentially been reset to where it started the year. Hope for 2024 is still found in the quarterly ECST survey that was published last month. The Q3 outlook in this survey shows 53% of participants projecting growth in Q3 with 18% expecting growth between 3% and 5%. Among the three product categories, the greatest optimism for Q3 growth is in Electro-Mechanical / Connectors with 61% anticipating growth and 24% believing growth will top 3%. The June ECST results and Q3 outlook results reinforce the expectation coming into 2024 that growth for the year would be driven by second half performance.

Continuing its solid sentiment compared to the other three groups, Manufacturers still delivered a score of nearly 110 in June in spite of a double-digit decline. Manufacturer Representatives and Distributors delivered index results decisively below the 100-point threshold at 97.3 and 93.2 points respectively.

Manufacturers and Distributors both anticipate a strong July rebound with scores improving to 120.9 and 117.9 respectively. By contrast, Manufacturer Representatives grow more pessimistic as they look toward July with their score declining further to 93.6. The July outlook would return the relative expectations between the three groups back to where they have typically been positioned over the past year.

Despite seeing its own steep decline, the index score for overall end markets sustained a score above 100 at 103.1 in June. The results for the individual market segments were mixed with half sustaining scores above 100: Avionics/Military/Space, Industrial Electronics, Computers, and Medical Electronics. In

the July outlook, Automotive Electronics and Consumer Electronics are expected to deliver scores at or above 100. Telecom Networks and Mobile Phones are seen lingering below 100.

Once again, an air of uncertainty pervades the electronics and electronics components industries as the markets battle continued economic headwinds. Perhaps, the key question is whether the progress being achieved in the world of technology will be enough to support improvement in the electronics markets despite the troubling economic environment.

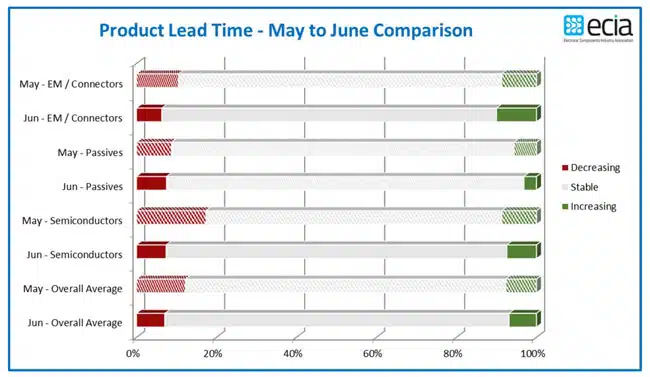

In general, the lead time status reported by the ECST is essentially unchanged between May and June. The only notable difference is seen in Semiconductors where the number reporting declining lead times fell from 17% in May to 7% in June. This change in the Semiconductor segment is likely due to the surge in demand for DRAM and NAND Flash memory. Still, stable lead-time reports continue to dominate as the share of respondents reporting stable lead times grew from 80% in May to 86% in June.