Zap Energy secures power supply manufacturing capabilities with acquisition of liquidated ICAR assets. The purchase of global capacitor manufacturer ICAR assets strengthens Zap’s engineering platform for advanced power supplies, a vital component in its repetitively-pulsed fusion energy technologies.

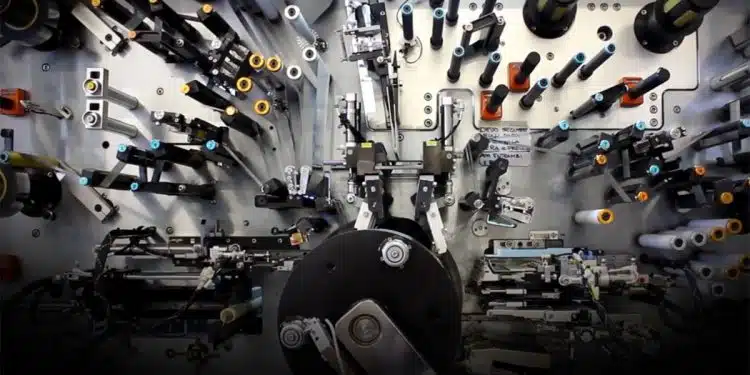

Zap Energy announced today that it has acquired a substantial package of liquidated assets from ICAR, formerly a leading global manufacturer of film capacitors and power supply equipment. The move is the first phase in building out Zap’s manufacturing capability in proprietary repetitive pulsed-power technologies and establishes a foundation for near-term development of a key system component.

“This lays the cornerstone in preparing plant-ready, repetitive pulsed-power,” said Benj Conway, Zap’s CEO and President. “Our future plant technology requires the development of specialized capacitors to power fusion — the ICAR acquisition gives us a several-year head start.”

A bank of capacitors is a key pillar of Zap Energy’s fusion technology. Capacitors store electrical energy that can be rapidly discharged into Zap’s devices, delivering extremely high current that creates fusion conditions in a plasma configuration known as a Z pinch. Zap is designing and building a repetitively pulsed system that delivers bursts of power from such capacitor banks multiple times per second.

“We now have both the equipment and the engineering talent to develop and build capacitors uniquely suited to the demands of our advanced repetitive pulsed-power systems,” said Matthew Thompson, Zap’s Vice President of Systems Engineering.

The equipment acquired by Zap from Italy-based ICAR represents the majority of the company’s global manufacturing line. During over 70 years in business, ICAR was a leading manufacturer in the development and production of high-performance capacitors. Among many applications, ICAR notably supplied capacitors to Lawrence Livermore National Laboratory’s National Ignition Facility for fusion experiments that achieved scientific breakeven last year. The company dissolved in 2021.