Dennis Zogbi, Paumanok Inc. publishes on TTI Market Eye June 2023 outlook on end markets for passive electronic components such as capacitors, resistors and inductors.

When we embarked on our research of passive components in the late 1980s, the computer industry emerged as a formidable competitor to the well-established consumer audio and video imaging markets. Since then, over the past 35 years, the dominance of mobile handsets has surpassed all other sectors in the high-tech economy. This has significantly influenced the design and trajectory of the capacitor, resistor and inductor industries, and it is expected to continue shaping their course for the next five years.

Moreover, the dynamic landscape of technology has witnessed various notable shifts. For instance, the transition from cathode ray tube to flat panel displays has revolutionized the visual experience. Furthermore, the ongoing “electronification” of automobiles has opened new avenues for development. Alongside these advancements, breakthroughs in medical implant technology, oil and gas electronics, renewable energy systems, data storage and munitions have presented valuable opportunities for component vendors who are keen on keeping up with market research reports.

By staying attuned to these market trends and embracing the potential offered by emerging technologies, component vendors can position themselves advantageously to capitalize on these opportunities.

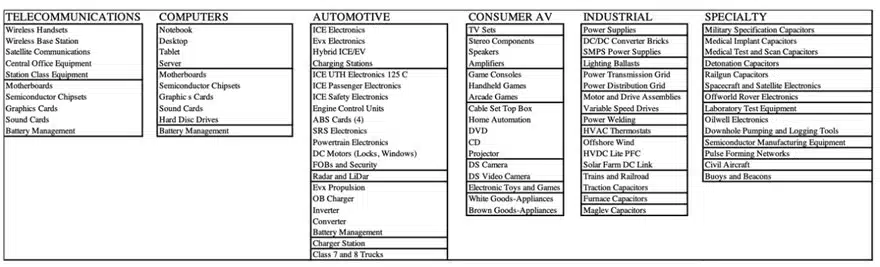

The traditional product-based end markets into which components are sold include:

- Telecommunication

- Computers and peripherals

- Automotive

- Consumer audio and video

- Industrial

- Specialty market segments

Within each category, specific products stand out:

- Wireless handsets

- Notebook computers

- Desktop computers

- TV sets

- Automobiles

- Power supplies

The industrial market segment can be further broken down into:

- Power supplies

- DC/DC converters

- Renewable energy systems

- Motors, fans and blowers

- Switchgear and switchboard applications

- Lighting

- Other line voltage equipment

Specialty markets can be further broken down into defense and aerospace, medical electronics, undersea cable, mining electronics, railroad electronics, instrumentation and control equipment, ocean electronics and oil and gas services electronics (downhole pump and data logging tools).

Products that we have studied over the past 35 years that lead the field in complexity and require the greatest commitment from capacitors, resistors and inductors include these products:

- Cardio implantable defibrillator

- Space craft power supply

- Smart watch

- MRI machine

- CT machine

- Life sciences DNA tester

- Semiconductor decoupling

- Downhole pump logging tools

- Under-the-hood engine control units

- Electric rail and traction

- DC link circuit for alternative energy

- Aircraft skin electronics

- Smartphone power amplifier

Based upon world region, the Asia-Pacific region accounts for between 70 percent and 80 percent of all components consumed, with China and Japan the two largest consuming countries, but Korea, Singapore, Philippines, Thailand, Malaysia and Indonesia are also key countries that build larger assemblies that require passive components to operate. The Americas and Europe account for between 10 percent and 15 percent of consumption of components each, and key consuming countries are Germany, the U.S., Mexico, Brazil, the Czech Republic, Hungary, UK, France and Italy.

(See MarketEYE TTI Article MAY 2023 – MARKETS BY REGION)

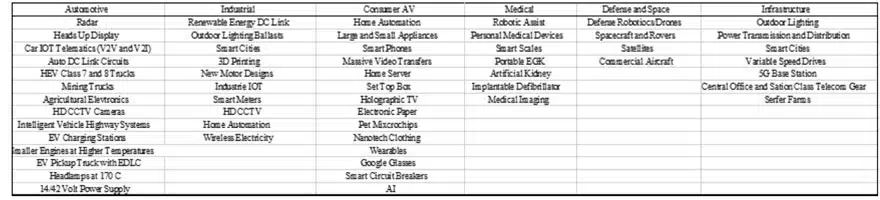

Key Growth Product Markets for Passive Components: 2023-2028

The following chart illustrates high growth end-use markets within each end-use market segment we study. All these products are passive electronic component intensive.

Telecommunications Equipment and the Passive Component Markets: FY 2023

The telecom sector is dominated by demand from the wireless handset business, with the movement from conventional cellular phones to smart phones a major driving force in the constant increase in unit shipments of MLCC, thick film chip resistors, SMD chip inductors and ultra-small tantalum chip capacitors. The smart phone has a considerably higher passive component content when compared to traditional legacy handsets.

Other products included in the telecom sector are wireless base stations; landline and cordless phones; GPS devices; telecommunications infrastructure equipment such as switches, routers and repeaters; PBX equipment; other base stations; cable modems and various forms of commercial satellites and related communication equipment.

Five-Year Outlook in the Telecommunications End-Use Market Segment

The global telecommunications market sector includes a wide range of products and services, such as mobile handsets, base stations, telecom infrastructure, broadband services and more. The demand for telecommunications products and services has been steadily increasing over the past few years, driven by factors such as the growth of mobile data usage, the expansion of broadband networks and the increasing adoption of new technologies such as 5G.

The telecommunications industry is continuously evolving with the introduction of new technologies such as 5G, the Internet of Things (IoT), artificial intelligence (AI) and cloud computing. These technologies are expected to continue driving the growth of the telecommunications industry in the coming years.

One of the most significant developments in the telecommunications industry is the ongoing deployment of 5G networks. 5G networks promise faster speeds, lower latency and higher capacity than previous generations of wireless networks. The widespread deployment of 5G networks is expected to drive the growth of IoT, autonomous vehicles, smart cities and other applications that require high-speed connectivity.

Another significant development in the telecommunications industry is the growing adoption of cloud computing. Many enterprises are migrating their data and applications to the cloud to take advantage of its flexibility, scalability and cost-efficiency. This shift towards cloud computing is expected to continue in the coming years, driving the growth of cloud-based services and solutions.

The COVID-19 pandemic has also had a significant impact on the telecommunications industry, with an increased demand for digital services and remote working driving growth in some areas of the market. However, the pandemic has also caused some disruptions to supply chains and delays in the deployment of new technologies, which may continue to affect the industry in the coming years.

Overall, the telecommunications industry is expected to continue growing in the next five years, driven by factors such as the widespread deployment of 5G networks, the growing adoption of cloud computing and the increasing demand for digital services. However, the industry is also likely to face challenges such as competition, regulatory issues and cybersecurity threats.

The World’s Top Consumers of Electronic Components in the Global Telecommunications Markets

The world’s top manufacturers of telecommunications equipment consuming capacitors, resistors and inductors include:

- Huawei Technologies Co. Ltd.: A Chinese multinational company that produces a wide range of telecommunications equipment, including smartphones, network infrastructure and enterprise solutions.

- Ericsson: A Swedish multinational company that produces telecommunications equipment, including network infrastructure, software and services for operators, enterprises and industries.

- Nokia Corporation: A Finnish multinational company that produces telecommunications equipment, including network infrastructure, software and services for operators, enterprises and industries.

- ZTE Corporation: A Chinese multinational company that produces telecommunications equipment, including network infrastructure, smartphones and enterprise solutions.

- Cisco Systems, Inc.: An American multinational technology company that produces a wide range of telecommunications equipment, including network infrastructure, software and services for enterprises and industries.

- Fujitsu Limited: A Japanese multinational company that produces a wide range of telecommunications equipment, including network infrastructure, software and services for enterprises and industries.

- Samsung Electronics Co. Ltd.: A South Korean multinational company that produces a wide range of telecommunications equipment, including smartphones, network infrastructure and enterprise solutions.

- Juniper Networks, Inc.: An American multinational company that produces telecommunications equipment, including network infrastructure, software and services for enterprises and industries.

- NEC Corporation: A Japanese multinational company that produces a wide range of telecommunications equipment, including network infrastructure, software and services for enterprises and industries.

- Alcatel-Lucent: A French multinational company that produces a wide range of telecommunications equipment, including network infrastructure, software and services for operators, enterprises and industries.

Other key players in the global telecommunications market, such as smartphone manufacturers and other electronic device makers, are also major consumers of electronic components.

Computer Markets for Passive Components: FY 2023

The computer and business machine segment, which includes motherboards, power supplies, monitors, hard disc drives, video graphics cards, modem cards and semiconductor chipset boards; as well as scanners, printers, fax machines, point of sale machines and photocopiers. Computers consume large volumes of higher priced capacitors, resistors and inductors and demand for high capacitance MLCC, tantalum chips and aluminum chip capacitors are dependent upon the computer market as a large percentage of total consumption as do chip resistors, resistor networks and ferrite beads.

The computer end-use market segment encompasses a wide range of products, including desktops, laptops, tablets and other computing devices. The market is driven by a variety of factors, including technological advancements, changing consumer preferences and economic conditions.

One of the most significant developments in the computer end-use market segment is the ongoing shift towards mobile computing devices, such as smartphones and tablets. These devices offer greater convenience and portability than traditional desktops and laptops and are increasingly being used for both personal and professional purposes.

Another significant development in the computer end-use market segment is the growing demand for high-performance computing (HPC) solutions. HPC solutions are used in a variety of industries, including healthcare, finance and scientific research, and are essential for processing large amounts of data and running complex simulations.

The COVID-19 pandemic has also had a significant impact on the computer end-use market segment, with an increased demand for digital devices and services driving growth in some areas of the market. However, the pandemic has also caused disruptions to supply chains and shortages of critical components, which may continue to affect the industry in the coming years.

Overall, the computer end-use market segment is expected to continue growing in the next five years, driven by factors such as the shift towards mobile computing devices, the growing demand for HPC solutions, and the increasing demand for digital devices and services. However, the industry is also likely to face challenges such as competition, economic uncertainty, and technological disruptions.

The World’s Top Consumers of Electronic Components in the Global Computer Markets

The world’s top manufacturers of computer equipment consuming capacitors, resistors and inductors include:

- Lenovo: Lenovo is a Chinese multinational computer technology company that produces a wide range of computing devices, including desktops, laptops, tablets and smartphones.

- HP Inc.: HP Inc. is an American multinational information technology company that produces a wide range of computing devices, including desktops, laptops, printers and other peripherals.

- Dell Technologies: Dell Technologies is an American multinational technology company that produces a wide range of computing devices, including desktops, laptops, workstations and servers.

- Apple Inc.: Apple Inc. is an American multinational technology company that produces a range of computing devices, including desktops, laptops, tablets and smartphones. It is known for its high-end products and innovative designs.

- Acer Group: Acer Group is a Taiwanese multinational hardware and electronics corporation that produces a range of computing devices, including desktops, laptops, tablets and monitors.

Other notable computer manufacturers include Asus, Huawei, Toshiba, Fujitsu and MSI. The computer manufacturing industry is highly competitive and companies must continue to innovate and adapt to changing consumer preferences and technological advancements to maintain their market share.

Five-Year Outlook in the Computer End-Use Market Segment

The computer industry has been evolving rapidly, with the market shifting towards mobile devices such as smart phones and tablets. However, traditional computing devices such as desktops and laptops are still widely used, especially in the business and education sectors.

The COVID-19 pandemic has accelerated the adoption of remote work and learning, which has increased the demand for personal computers and laptops. This trend is expected to continue in the next few years, with many organizations investing in remote work infrastructure and upgrading their computer systems to support this new way of working.

Another significant trend in the computer industry is the growing demand for high-performance computing (HPC) solutions, driven by the increasing use of artificial intelligence (AI) and machine learning (ML) in various applications. HPC solutions are used in a variety of industries, including healthcare, finance and scientific research and are essential for processing large amounts of data and running complex simulations.

In the next five years, the computer industry is expected to continue evolving, with a continued shift towards mobile devices and the increasing adoption of new technologies such as AI and ML. The demand for HPC solutions is also expected to continue growing, driven by the increasing use of these technologies in various industries.

However, the computer industry may also face challenges such as supply chain disruptions, shortages of critical components and regulatory issues, which may affect the availability and cost of computing devices. Overall, the computer industry is expected to continue growing, driven by technological advancements, changing consumer preferences and the increasing demand for digital devices and services.

Consumer Audio and Video Imaging Markets for Passive Components: FY 2023

Consumer electronics is a broad category and many of the top Japanese vendors of passive electronic components to the segment further dichotomize the market into consumer audio and video imaging equipment. The other popular term is home theatre electronics, which is even more encompassing and is an entrée into smart home electronic technology of the future. Consumer audio and video imaging equipment had been the largest segment for consumption for all passive components in dollar value, however, it has been eclipsed by both the telecom and computer market segments over the past three years, and now even the automotive segment and the industrial segment will surpass it in overall value.

It is still a valuable segment (what Paumanok Japan customers would describe as “the segment on which all the other segments were founded upon”) and the large volume of demand is from the television set, game console, MP3 player, digital video camera, digital still camera and stereo market segments. Many of the peripheral markets, such as portable game consoles, MP3 players, digital cameras and portable GPS devices have declined due to the success of the smartphone, which offers the consumer the functionality of these devices in the “converged” smart phone.

Five-Year Outlook in the TV Set and Home Theatre End-Use Market Segment

The TV set and home theater market segment have been evolving rapidly with the emergence of new technologies such as 4K and 8K displays, HDR and smart TV features. The COVID-19 pandemic has also influenced this market segment, with more people staying at home and spending time watching TV shows and movies.

In the next five years, the TV set and home theater market segment are expected to continue growing, driven by technological advancements, changing consumer preferences and the increasing demand for digital entertainment. Some of the key trends and forecasts for this market segment include:

- Increasing demand for larger and higher-resolution displays: As consumers look for more immersive and cinematic viewing experiences, the demand for larger and higher-resolution displays is expected to increase. 4K and 8K displays are becoming more affordable and their adoption is expected to continue growing in the coming years.

- Growing adoption of smart TVs: Smart TVs are becoming more popular, as they offer users access to a wide range of streaming services and other digital content. The adoption of smart TVs is expected to continue growing in the coming years with more manufacturers adding smart features to their products.

- Shift towards streaming services: The popularity of streaming services such as Netflix, Amazon Prime Video and Disney+ is expected to continue growing, as more consumers cut the cord with traditional cable and satellite TV providers. This trend is expected to drive the demand for internet-connected devices such as smart TVs, streaming media players and gaming consoles.

- Increasing demand for home theater systems: As more people spend time at home, the demand for home theater systems is expected to continue growing. Home theater systems offer a more immersive and cinematic viewing experience and the availability of more affordable soundbars and speakers is expected to drive their adoption in the coming years.

Overall, the TV set and home theater market segment is expected to continue growing, driven by the increasing demand for digital entertainment and the emergence of new technologies. However, the market may also face challenges such as supply chain disruptions, shortages of critical components and changing consumer preferences, which may affect the availability and cost of TV sets and home theater systems.

The World’s Top Consumers of Electronic Components in the Consumer Audio and Visual End Markets

Some of the top manufacturers of TV sets and home theatre electronics in the world include:

- Samsung Electronics: Samsung is a South Korean company that is one of the world’s largest manufacturers of TV sets and home theatre electronics. The company offers a wide range of products, including (quantum dot LED) QLED, 4K and 8K TVs, soundbars and home theatre systems.

- LG Electronics: LG is another South Korean company that is a major player in the TV set and home theatre electronics market. The company offers a range of products, including (organic LED) OLED, 4K and 8K TVs, soundbars and home theatre systems.

- Sony Corporation: Sony is a Japanese company that is well-known for its high-quality TV sets and home theatre electronics. The company offers a range of products, including OLED, 4K and 8K TVs, soundbars and home theatre systems.

- TCL Corporation: TCL is a Chinese company that has become a major player in the TV set market in recent years. The company offers a range of products, including QLED, 4K and 8K TVs, soundbars and home theatre systems.

- Hisense: Hisense is another Chinese company that has become a significant player in the TV set and home theatre electronics market. The company offers a range of products, including QLED, 4K and 8K TVs, soundbars and home theatre systems.

- Panasonic Corporation: Panasonic is a Japanese company that has been a major player in the TV set and home theatre electronics market for many years. The company offers a range of products, including OLED, 4K and 8K TVs, soundbars and home theatre systems.

- Vizio Inc.: Vizio is an American company that has become a significant player in the TV set and home theatre electronics market in recent years. The company offers a range of products, including LED, 4K and 8K TVs, soundbars and home theatre systems.

- These are just a few of the top manufacturers of TV sets and home theatre electronics in the world and there are many other companies that also offer high-quality products in this market segment.

Automotive Markets for Passive Components: FY 2023

Automotive electronics include engine control units, anti-lock braking system (ABS) cards, supplemental restraint system (SRS) electronics, car stereos, HVAC systems, driver information and diagnostic systems, powertrain electronics, HEV integration, door locks, seat motors, interior and exterior lighting, instrument clusters and related electronics.

There are two key trends: The first is electric vehicle propulsion and the second is connected, autonomous, shared and electric (CASE) in (internal combustion engine) ICE fossil fuel electronics for ADAS (advanced driver assistance systems). The extension of this is the supporting power infrastructure for charging stations and offshore wind projects.

A solid embracing of carbon emission guidelines and a clear movement away from fossil fuel electronics in favor of electric transport technologies in accordance with the Paris Accords, Tokyo Agreement and with an eye on Green Bond Investing.

The increase in demand for high voltage MLCC with soft polymer terminations, tantalum and aluminum electrolytic and plastic film capacitors as well as for industrial grade resistors and inductors is the direct result of this transition. The reader should also remember for forecasting that we are using the strong U.S. dollar. These markets have incredible upside potential in value between 2024 and 2028 because automotive converters, inverters, chargers and battery systems are net new opportunities that do not cannibalize existing ecosystems because of the high voltage nature of electric vehicle propulsion which is alien to fossil fuel vehicle electronics.

Five-Year Outlook in the Automotive End-Use Market Segment

The automotive industry is currently undergoing significant changes driven by technological advancements, changing consumer preferences and increasing environmental regulations. In the next five years, the automotive end-use market segment is expected to continue evolving, with a focus on electric and autonomous vehicles, connectivity and new business models.

Some of the key trends and forecasts for the automotive end-use market segment over the next five years include:

- Increasing adoption of electric and autonomous vehicles: The adoption of electric and autonomous vehicles is expected to continue growing in the coming years, driven by increasing concerns about climate change, advances in battery technology and regulatory incentives. More automakers are investing in electric and autonomous vehicle technology, and the availability of more affordable models is expected to drive their adoption.

- Shift towards mobility-as-a-service: The rise of ride-sharing and other mobility services is expected to continue growing, as consumers look for more convenient and cost-effective ways to get around. Automakers and technology companies are investing in mobility-as-a-service platforms and new business models that could disrupt the traditional automotive industry.

- Growing demand for connected cars: The demand for connected cars is expected to continue growing, as consumers look for more convenience and safety features. More automakers are adding connectivity features to their vehicles, such as in-car infotainment systems, GPS navigation and driver assistance technology.

- Focus on sustainability: Automakers are increasingly focusing on sustainability, with a focus on reducing emissions and improving fuel efficiency. The adoption of electric and hybrid vehicles is expected to play a significant role in reducing emissions, and more automakers are investing in alternative fuel technologies such as hydrogen fuel cells.

- Increasing competition and consolidation: The automotive industry is becoming more competitive with new players entering the market and established automakers investing in new technologies. As the industry evolves, there is also a trend towards consolidation, with mergers and acquisitions expected to continue in the coming years.

Overall, the automotive end-use market segment is expected to continue evolving rapidly in the next five years, with a focus on electric and autonomous vehicles, connectivity, and new business models. However, the industry may also face challenges such as supply chain disruptions, changing consumer preferences and regulatory uncertainties, which could impact the pace and direction of innovation.

The World’s Top Consumers of Electronic Components in the Global Automotive Markets

Electronic components have become an integral part of modern automobiles, helping to improve safety, efficiency and comfort. The use of electronic components in automobiles is expected to continue growing, driven by increasing consumer demand for features such as infotainment systems, driver assistance technologies and connected services.

Some of the key trends shaping the automotive industry and driving the demand for electronic components include:

- Autonomous driving: The development of autonomous driving technologies is expected to drive the adoption of electronic components in automobiles, such as sensors, cameras and control units.

- Electric vehicles: The growth of electric vehicles is expected to increase the demand for electronic components, such as batteries, power electronics and charging systems.

- Connected cars: The demand for connected cars is expected to continue growing as consumers seek more advanced infotainment systems, navigation and other services. This is expected to drive the adoption of electronic components such as communication modules, sensors and data processing systems.

- Safety features: Electronic components are also being used to improve safety in automobiles, such as ADAS, collision avoidance systems and monitoring systems.

The automotive electronic sub-assembly market is highly competitive, with many companies offering a wide range of products and services. Here are some of the top manufacturers of automotive electronic sub-assemblies in the world:

- Bosch: Bosch is a leading global supplier of automotive electronic sub-assemblies, offering a range of products such as engine management systems, ADAS systems, infotainment systems and body electronics.

- Continental: Continental is a major player in the automotive electronics market, offering a range of electronic sub-assemblies such as powertrain systems, ADAS systems and vehicle networking systems.

- Denso: Denso is a leading supplier of automotive electronic sub-assemblies, offering a wide range of products such as airbag systems, engine management systems and powertrain systems.

- Aptiv: Aptiv is a leading supplier of automotive electronics and electrical systems, offering products such as infotainment systems, advanced safety systems and vehicle connectivity solutions.

- Delphi: Delphi is a major supplier of automotive electronic sub-assemblies, offering products such as powertrain systems, advanced safety systems and connectivity solutions.

- Lear: Lear is a leading supplier of automotive electronics and electrical systems, offering products such as infotainment systems, seating systems and connectivity solutions.

- Panasonic: Panasonic is a major supplier of automotive electronic sub-assemblies, offering products such as infotainment systems, ADAS systems and powertrain systems.

- Visteon: Visteon is a leading supplier of automotive electronics and electrical systems, offering products such as infotainment systems, climate control systems and ADAS systems.

These companies are among the top players in the automotive electronic sub-assembly market, but there are many other companies that also offer a wide range of products and services. The automotive electronics market is expected to continue growing in the coming years, driven by increasing demand for connected, autonomous and electric vehicles, as well as advanced safety features and infotainment systems.

Electric vehicle propulsion represents a net new market opportunity for vendors of high voltage passive electronic components, especially those that employ polymer cathodes (Al203, Ta205) or polymer terminations (HV MLCC) or PP dielectrics (X&Y and Snubber) and there is a clear trend to consume more polymers in EVx because of the “self-healing” aspect of the part when subjected to high voltages.

Industrial and Power Markets for Passive Components: FY 2023

This segment experienced a dramatic upswing in value due to consumption of large can capacitors for applications in electric vehicle charging and offshore wind power generation, transmission and distribution. This basket category of “industrial” products also includes (primarily) power transmission and distribution capacitors, power supplies, large home appliances, renewable energy systems, switchgear and switchboard apparatus and motor controllers. Power film capacitors, screw terminal aluminum electrolytic capacitors, high voltage ceramic capacitors, wirewound and nichrome resistors and power inductors are consumed in this segment of the market.

This market had experienced significant activity related to power efficiency and for DC link circuits for renewable energy systems in wind and solar farms.

This had a positive market effect on polypropylene film capacitors and large can aluminum electrolytic capacitors and the market received a boost due to demand for upgrades of industrial automation equipment, edge to cloud industrial automation, which requires new machines that meet targeted efficiency requirements.

Five-Year Outlook in the Industrial End-Use Market Segment

The industrial sector encompasses a wide range of industries, including manufacturing, construction, energy and transportation. The use of advanced technologies and automation is transforming the industrial sector, leading to increased efficiency, productivity and safety.

Some of the key trends shaping the industrial sector and driving growth in the use of electronic components and automation technologies include:

- Industry 4.0: Industry 4.0 refers to the digital transformation of the industrial sector, leveraging technologies such as the Internet of Things (IoT), artificial intelligence (AI) and cloud computing to enable smart factories, predictive maintenance and other advanced applications.

- Robotics and automation: Robotics and automation technologies are increasingly being used in the industrial sector to perform repetitive or dangerous tasks, improve quality control and increase efficiency.

- Energy efficiency and sustainability: The industrial sector is a major consumer of energy, and there is growing demand for technologies that can improve energy efficiency and reduce environmental impact.

- Smart infrastructure: The development of smart infrastructure, including smart cities and smart transportation systems, is expected to drive demand for advanced electronic components and automation technologies.

- The outlook for the industrial sector in the next five years is positive, with continued growth expected in many areas. The adoption of Industry 4.0 technologies and automation is expected to accelerate, leading to increased efficiency and productivity. The development of new technologies, such as 5G wireless networks and edge computing, is also expected to enable new applications and drive growth in the industrial sector.

Overall, the industrial sector is expected to continue evolving rapidly in the coming years, driven by the adoption of advanced technologies and the increasing demand for efficiency, productivity and sustainability.

The World’s Top Consumers of Electronic Components in the Global Industrial End-Use Markets

The industrial sector is a major consumer of electronic components, which are used in a wide range of applications such as factory automation, process control, robotics and energy management. Some of the most used electronic components in the industrial sector include

- Microcontrollers and microprocessors: These are used in a wide range of industrial applications, including machine control, automation and monitoring.

- Power electronics: Power electronics components, such as inverters, rectifiers and DC-DC converters, are used in industrial applications such as motor control, power supply systems and energy management.

- Sensors: Sensors are widely used in the industrial sector for monitoring and control, including applications such as temperature sensing, pressure sensing and motion sensing.

- Memory and storage devices: These are used in industrial applications such as data acquisition, control systems and monitoring.

- Communication and networking components: These are used in industrial applications such as factory automation, process control and monitoring.

- Display and visualization components: These are used in industrial applications such as human-machine interfaces (HMIs) and process visualization.

The top consumers of electronic components in the industrial sector are likely to be companies that specialize in industrial automation, process control, robotics and energy management. These companies are likely to require a wide range of electronic components for their products and services, including microcontrollers, sensors, power electronics, communication components and memory devices.

The industrial equipment market is highly diverse, with numerous companies operating across a wide range of sectors, including manufacturing, construction, energy and transportation. Some of the top manufacturers of industrial equipment include

- Caterpillar Inc.: Caterpillar is a leading manufacturer of heavy equipment, including construction equipment, mining equipment and diesel engines. The company also provides services such as financing, rental services and remanufacturing.

- Siemens AG: Siemens is a global technology company that provides products and services across multiple industries, including energy, healthcare and transportation. In the industrial sector, the company offers products such as automation systems, control systems and power distribution equipment.

- General Electric Company: GE is a diversified company that operates across multiple industries, including energy, aviation and healthcare. In the industrial sector, GE provides a wide range of products and services, including automation systems, power generation equipment and transportation systems.

- ABB Ltd.: ABB is a Swiss multinational company that specializes in power and automation technologies. The company offers a wide range of products and services for the industrial sector, including robotics, control systems and power electronics.

- Schneider Electric SE: Schneider Electric is a French multinational company that provides energy management and automation solutions for the industrial sector. The company offers products such as sensors, control systems and power distribution equipment.

- Honeywell International Inc.: Honeywell is a diversified technology company that provides products and services across multiple industries, including aerospace, defense and automation. In the industrial sector, the company offers products such as automation systems, sensors and control systems.

- Emerson Electric Co.: Emerson is a global technology company that provides products and services for multiple industries, including energy, healthcare and transportation. In the industrial sector, the company offers products such as automation systems, control systems and sensors.

- Mitsubishi Electric Corporation: Mitsubishi Electric is a Japanese multinational company that provides products and services across multiple industries, including industrial automation, energy and transportation. In the industrial sector, the company offers products such as automation systems, control systems and power electronics.

These are just a few of the top manufacturers of industrial equipment in the world, and there are many other companies that also play a significant role in this market.

Specialty Electronics Segment (Defense, Medical, Oil & Gas, Mining and Other): FY 2023

The specialty electronics market segment includes five discernible sub-segments: medical electronics, oil well electronics, mining electronics and defense electronics (we include a fifth category to include all other unique segments that require unusual voltages or operate at unusual frequencies or at different levels of chemical, gas or radiation exposure or at elevated temperatures to 350° C). Defense is by far the largest segment, accounting for the majority of the specialty electronics markets worldwide. The medical and spacecraft segments are the most demanding, but also the most profitable. Oil and gas electronics are also quite demanding and very profitable passive component market segments as well.

The specialty electronics market segment includes several discernible end-market segments:

- Defense, space and civil aviation: Require capacitors, resistors and inductors for high voltage, high frequency and high-temperature applications. The market includes all passive component mil-spec passive electronic components, all ESA and NASA qualified parts.

- MedTech electronics: Includes the unique implantable defibrillator supply chain and the unique high/voltage + high-frequency test and scan equipment markets.

- Oil and gas electronics: Includes advanced logging tools and downhole pumping electronics. High temperature and high vibration frequency at high voltage is a demanding environment.

- R&D laboratory test and measurement equipment: High-frequency and high voltage passive components required.

- Communications Infrastructure: Includes high frequency electronic components for communications transmission and networking with emphasis upon optical networking, undersea cable and fiber optic backbone repeater technologies.

- Semiconductor manufacturing: Requires unique vacuum variable capacitors at high voltage and high frequency.

- Specialty power: This segment includes “power electronics” which require capacitors, resistors and inductors for traction, furnace, and welding.