This article written by Dennis Zogbi, Paumanok Inc. published by TTI Market Eye provides an overview and mapping of magnetic components market and its applications.

We estimate the global magnetic and inductor components business at $6.2 billion in market value for FY 2024, of which inductors EMC components, and ferrites account for 45% of worldwide consumption value, and PCB transformers, magnets, sheets and materials account for the larger 55% of the magnetic component consumption value worldwide.

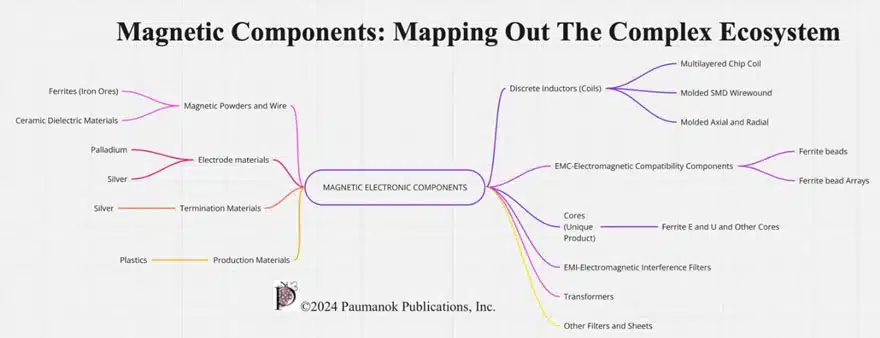

The following chart maps out the complex magnetic components market, including component types and configurations as well as feedstocks.

GLOBAL COMPONENT TECHNOLOGIES: MAGNETIC COMPONENTS

The larger volume business in magnetic components can be found in SMD chip coils, ferrite beads, bead arrays, axial and radial micro-inductors, and ferrite cores. They are referred to as “inductors” because they have inductive properties, which means that when an electric current is applied to an inductor a magnetic field is produced, or just the opposite, that when a magnetic field passes through an inductor, it produces a corresponding current. For example, the basic function of a DC motor is that when a magnet is moved back and forth through a coil, it creates a counter-current to balance out the opposing electric field. This is the basic function of all DC motors.

Another variation on the inductor theme is that when a core is placed inside the coil wire, it can concentrate the magnetic field lines. Different types of core materials are used to manipulate and control the number of types of magnetic field lines created by the inductor. The ability to concentrate the magnetic field lines of an inductor is known as core permeability.

VARIATIONS IN COIL TECHNOLOGY

Inductance is referred to as (L) in the product literature and in subsequent architecture and mapping of components on a printed circuit board. The inductance (L) is basically the ability of the component to control the number and type of magnetic field lines being generated by the inductor. The manipulation and control of the inductor can be affected by the following three important criteria:

Coil Diameter

An increase in the diameter of the wire will result in increased inductance of the corresponding inductive component.

Wire Turns

By increasing the number of turns of the wire around the core, the inductance can also be increased. This places emphasis upon the thickness of the wire employed or the type of materials used for the wire.

Core Materials

The inductance can also be increased by the basic application of a magnetic core upon which the wire is wound. Variations in core materials will also enhance the ability to produce inductance.

Therefore, it is important for the reader to note that variable production costs for magnetic components can be impacted by coil diameter and wire turns as well as the feedstock costs for coil and wire materials.

INDUCTOR APPLICATIONS IN DIGITAL ELECTRONICS

Inductors (coils) are used in modern digital electronics to control signals to eliminate unwanted noise, to store energy, and to regulate voltage.

Signal Control

At low frequency or no frequency, direct current (DC) flows unimpeded through a circuit. As frequency is applied, the ability for voltage to pass through becomes impeded. Inductors (coils) are used to regulate these naturally occurring phenomena.

Noise Control and Elimination (LC Filter)

Noise generation is a major concern in the design of modern, compact digital electronics. The greater the proximity of the components, the greater the possibility of noise generation impacting the proper performance of the circuit. Inductors are used in conjunction with capacitors (such as the MLCC or the DC film capacitor) to create an L-C filter to either eliminate or to control the noise in high-frequency circuits.

Energy Storage and Voltage Stabilization

Inductors (coils) can store magnetic energy by employing the principle of reactive magnetic flux, which is the natural phenomenon that occurs when a magnet tries to counteract the balance created by an applied magnetic field. Energy can be stored in the windings and core of the coil as a result of this process. Inductors are used in DC/DC converters because of their reactive magnetic flux to stabilize the voltage.

THE DIFFERENT TYPES OF INDUCTORS

It is important for the reader to understand that the basic principle of all inductors remains the same – that a coil must be created to achieve the desired inductance necessary for the circuit operation. How this coil is created differentiates between inductor types.

Therefore, there are two basic types of coils created – one that involves the winding of a wire (either with an air core, no core, or around a core composed of iron oxide or alumina ceramic) and a deposited thin film coil.

Wirewound Coils

Wirewound coils include molded case inductor chips, where the wire is wound on a small core and housed in a molded case.

Wirewound coils are also used to create ferrite cores and in axial and radial leaded designs for automotive, defense and consumer electronics applications.

Multilayered and Thin Film Deposited Coils

Metal coils can also be deposited using thin film technology to create a box-type or circular pattern on a ceramic or ferrite substrate. This process is used to create ferrite beads and bead arrays. The more complex creation of multilayered chip inductors also employs a thin film deposition technique but in a monolithic three-dimensional format, whereby the coil is stacked up between layers of electrode materials.

Feedstocks: Magnetic Materials

Magnetic material feedstocks can be processed into powders and extruded into stacked green sheet methods in the same manner as barium titanate ceramics used in ceramic capacitor production, however, only a few layers are needed to create the 3-dimensional coil to achieve the specific nano henries required (the aid to reduce impedance and unwanted noise). Ceramic dielectric materials such as low-loss P90 porcelain ceramics, barium strontium titanate (thin inductor films), and neodymium titanate to 5 GHz are key chemical compositions consumed in ceramic chip inductors.

Ferrites, which are metal-based, have limitations in terms of their frequency operation, however, they are critical because of their flux capabilities in power supplies. This makes them extraordinarily important for the creation of ultra-small power supplies consumed in many end-markets in electronics. Ferrite powders include such mixed metal materials as MnZn, NiZn, and MgZn.

Magnetic Component Configurations

The following describes the types and configurations for magnetic components:

Ferrite Beads and Bead Arrays

There are a large number of ferrite beads and bead array vendors serving the global market. Ferrite beads and bead arrays are simple components to manufacture and therefore there is an ease of market entry. These products have low prices compared to other types of inductors, but, in fact, have high prices compared to other mass-produced passive components (such as the MLCC or thick film chip resistors). These components are consumed in relatively large volumes in computers and handsets for noise abatement. This is a rendered economy and an important one. The margins and volumes are extremely attractive.

Multilayered Ceramic Chip Inductors (Chip Coils)

The number of vendors of multilayered chip inductors is more constrained compared to other inductor components because of the ceramic stacking technology required to build up a multilayered design. These components are consumed in wireless handsets, computer motherboards, and a variety of consumer-related electronic products.

Horizontal Wirewound Chip Inductors

The reader will note that many global vendors catering to industrial and power supply chains sell the horizontal wirewound chip inductor. This product line has the most vendors of all products surveyed and reflects a sizeable market. Demand for surface mount wirewound inductors is primarily in computer motherboards and in telecommunications and data communications infrastructure equipment. These markets represent the areas where component vendors can expect the highest margins for their product lines.

Axial and Radial Leaded Inductors

The number of vendors of axial and radial leaded inductors is limited as these are considered “legacy” parts that are kept in production because of high margins due to deprecated capital equipment costs over time. These products are consumed in industrial electronic applications and in many instances can be considered to be legacy components.

Ferrite Cores (E Cores, Pot Cores, and Other Cores)

The number of vendors of cores is also limited compared to the number of vendors competing in other types of components. Within the core market, there are also sub-categories that comprise the standard “E” core and the “Pot Core” but then the number of vendors dwindles as we move into specialty core shapes.

DISCRETE INDUCTOR CONSUMPTION BY END-USE MARKET SEGMENT: CATEGORY ANALYSIS

Wireless Handset Markets for Discrete Inductors

The inductor markets rely heavily on the handset business to set market direction and value. The number of viable vendors of quality inductors is limited and many vendors have been attempting to acquire companies in the space. Handsets consume ferrite beads, arrays, and coils for impedance matching of circuits and for noise protection in modules, microphones, cameras, and speaker circuits.

Automotive Markets for Discrete Inductors

Discrete inductors are consumed in automobiles for transition to EVx propulsion and CASE Automotive trends in ICE systems. The automotive segment continued to outperform other sectors as car demand increased in emerging economies. The markets demand SMD coils, EMC inductive chips, and ferrites into the automotive electronic subassemblies industry. A clear movement toward supplying clean electronic solutions. Other vendors in the space are active here through sales of inductors, beads, and cores for applications beyond the firewall. This includes components for the stereo, navigation system, XM Radio, and driver computer. The more profitable segment is for applications in the ABS cards, the airbag igniter circuits, tire pressure monitoring, and the electrification of the powertrain.

Industrial and Infrastructure Markets for Discrete Inductors

Discrete inductor sales to the power and industrial segment for power supplies is an important market for the larger inductor product and legacy component programs. A renewed movement in German industrial automation (F4 Upgrade) drove up sales for high-voltage inductors. Power supply demand also remained robust worldwide, growing in almost every industry but oil and gas electronics and key growth opportunities in backbone telecom infrastructure for data transmission and connections.

Computer Markets for Discrete Inductors

Computers require inductors for noise abatement in key circuits. This increases across-the-board applications in desktop, notebook, tablet, and server designs with ferrite cores also consumed in key processing applications.

Consumer AV Markets for Discrete Inductors

Consumer home theatre electronics, including television sets, are a significant end market for discrete inductors also for noise abatement in compact electronics. Inductors are also found in game consoles and cable set-top boxes.

Specialty Markets for Discrete Inductors: FY 2022

Discrete Inductor sales to the specialty markets include sales to commercial aerospace, defense space, and medical end markets. This market segment includes mil-spec, MedTech, instruments, lab equipment, space electronics, and commercial aircraft or any circuit requiring a high voltage, high temperature or high-frequency magnetic solution.

TRENDS AND DIRECTIONS IN MAGNETIC COMPONENTS: INDUCTOR GROWTH TECHNOLOGIES

Thin Film Ceramic Inductors

The thin film market is just emerging. In a meeting with key component vendors, it was revealed that there was a concerted effort underway to rapidly expand their thin film chip inductor business because the pricing was very favorable, and the technology could be extended into extremely small case sizes. As we have noted the market is based solely on barium strontium titanate thin film, and the process comes from semiconductor manufacturing which will be critical to all next-generation component technology in passives (CRL).

Next Generation 008004 Case Size

We are reporting a clear movement toward ultra-small case-size ceramic chip inductor technology using photolithography techniques as opposed to the traditional multi-layered stacking technology to achieve 01005 and the new 08004. The overlap in the 0201 and the 0402 using both thick and thin film solutions is also apparent and the technology in both thick and thin film will continue to develop and grow, but all vendors must be focused on new equipment and technology platforms and disciplines required to run thin film, simply because in the mind of the design engineer, the concept of thin film promotes the idea of greater precision and better performance, but the differences are actually very slight and we bet both stacking and lithography have a long way to go here because pricing is so extremely high in comparison to other components with larger economies of scale.

MLCI and thin film chips are exciting markets compared to other products we view here at Paumanok. Also, the thin film approach may offer greater latitude in intellectual property development given that the process flow has changed. The focal point on the usage of barium strontium titanate for thin film material suggests other materials may also be used that would improve upon the Q Factor, the current rating, or the nano-Henrie value of individual chips.

Low Profile MLCI and Thin Film Chip Inductors

The lower profile chips are in great demand in modules and handsets as thinner devices are in great demand from the consumer. This gets translated down the line to all component vendors to toe the line and develop technology that rewrites the very laws of nature and figures out ways to increase the available surface area of the component.

This has changed in inductors through materials selection and technology platform. First, the movement has been away from traditional ferrites toward more mainstream ceramic dielectrics. In the thick film, the technology has been amazing and has focused on the three-dimensional development of the core spiral. Lower profile parts create problems because they limit the available surface areas to create the spiral and thus limit nano-henries.

Future Markets in THz Frequencies

Future market opportunities for advanced magnetic components are being projected for applications from 300.1 GHz to 3,000 GHz, or into the terahertz range. Potential future applications include terahertz imaging – a potential replacement for X-rays in some medical applications, ultrafast molecular dynamics, terahertz time-domain spectroscopy, terahertz computing/communications, sub-mm remote sensing, and geothermal exploration.